The average US tax return is over $3000. Chances are, you’ve got some money coming to you from your tax return.

I know, I know. Financial planners say that tax returns are bad. It’s an interest-free loan to the government.

Problem is, if you earn a certain amount and have kids, you can usually expect a return.

What we do is use our tax return to help save more money. Here are some of the ways that we’ve used our tax return to save us money for now and later:

1. Pay down or off some debt

You’re probably rolling your eyes. This is the canned answer, right? Of course you should pay down debt. But that’s no fun.

Or is it?

Like me, you hear about how many thousands of dollars are wasted in credit card debt. You may cringe and mutter that you really need to pay that debt down. And you avoid it, because debt is just too overwhelming.

But if you can pay off a debt, no matter how small, it can really make a difference in your overall financial health. This last year, I paid off a credit card. That paid debt saved me $80 a month in interest payments. I was so excited! I wanted to show off my $0 balance. Too bad that’s not as acceptable to share that on social media as fancy vacations and big renovations.

Potential savings: $1000 dollars a year or more

2. Buy a deep freezer

Buying a deep freezer was one of the best things I did with my tax return. With a chest freezer, I was able to save 35% off my grocery bill, since I could buy meats and vegetables at their lowest price and freeze them. Plus, I now had the room to store freezer meals. Even with the annual cost of operating, my freezer paid for itself in a year.

Potential savings: $1600 dollars a year

3. Buy a canner

In addition to a deep freezer, you may want to get a canner to help preserve meats and vegetables. I’ve canned with a water-bath canner for years, putting up pickles and jams. However, I’d never attempted to use a pressure canner (You need a pressure canner to can meat products and many vegetables). I was terrified that it would blow up on me. But a few years ago, I used my return to get a pressure cooker. Why did I wait so long? It’s so easy to can a batch of chicken stock. I’ve saved a lot of money canning spaghetti sauce with meat and dried beans. Having all this food on hand keeps us from going out to eat when we’re too busy for more than a quick meal.

Potential savings: $500 dollars a year

4. Create a medical emergency fund

A lot of people avoid going to the doctor because they are uninsured or under-insured. I understand. We are on a high-deductible plan and end up paying out-of-pocket for our medical bills.

However, most people in this situation tend to wait as long as they can to go to the doctor, because it’s too expensive. Then, the problem because so critical that they end up in the emergency room after hours.

According to debt.org, the following are nine of the most common reasons people visit the ER:

- Allergies

- Acute bronchitis

- Earache

- Sore throat

- Pink eye

- Sinusitis

- Strep throat

- Upper respiratory infection

- Urinary tract infection

Unless you are immune-compromised or have other medical complications to consider, all of those conditions can be treated for far cheaper in a doctor’s office. The average cost of going to the ER was $1300 in 2009. It’s estimated that Americans could save 18 billion dollars a year by using primary care physicians over the ER. Wow!

ERs are a far pricier option than going to the doctor in the first place, especially since the average cost of a doctor’s visit is $100. Stash a few hundred dollars from your return for an emergency medical fund and you’ll have that available when a medical crisis arises.

Potential savings: $1200 dollars

5. Start a buy-in-bulk fund

Grocery shopping one day, I found a display of ground beef for $1.25 a pound. $1.25 a pound! So I loaded up my shopping cart with 100 pounds of ground beef. Sure, I got some strange looks from the cashier. But I knew that I wouldn’t be able to beat that price for a long time. I froze the meat, and we’ve eaten it over the last year.

Even at the great savings of $1.25/lb, dropping $125 on meat would take a serious bite out of my monthly grocery budget. I never would have been able to do it had I not had a chunk of money set aside just for this purpose. If you take $200 and stash it in an account, you have that money to spend when you stumble upon a fantastic grocery deal. You could even replenish your bulk buying fund bit by bit with the savings that you’ve gained with purchasing items at their lowest price.

Potential savings: $250-300 dollars

6. Tackle some home repairs

A little drip can turn into a big problem under your sink, if you let it continue. But if you spend the money to fix that leak, you can save hundreds of dollars in major repairs. We had a soffit (that’s the wood or siding underneath the eaves) that needed repairing. It costs us about $150 to repair it using a handyman. But if we had waited, we could have had serious damage to the roof, costing thousands of dollars. Other repairs that can save you money in the long run are fixing cracked toilets, re-caulking tubs, and re-staining kitchen cupboards that have had the varnish rubbed off.

Potential savings: $500-2000 dollars

7. Tackle some car maintenance

Confession time here: When I bought my first car, I budgeted for the car payment and for the insurance payment. I didn’t think about maintenance costs. I avoided taking the car in for oil changes and checkups. After all, that cost money that I didn’t have.

So we drove the car for four years, when clunk! We broke a timing belt. Our car was dead.

If we had kept up with regular maintenance, we could have saved thousands of dollars, as we scrambled to purchase a replacement vehicle that we weren’t ready.

Use your return to inspect and replace brake pads, transmission fluid, or any number of car maintenance repairs that your car might need.

Potential savings: $6000 dollars a year or more (a car payment or expensive repairs)

8. Add to the house fund

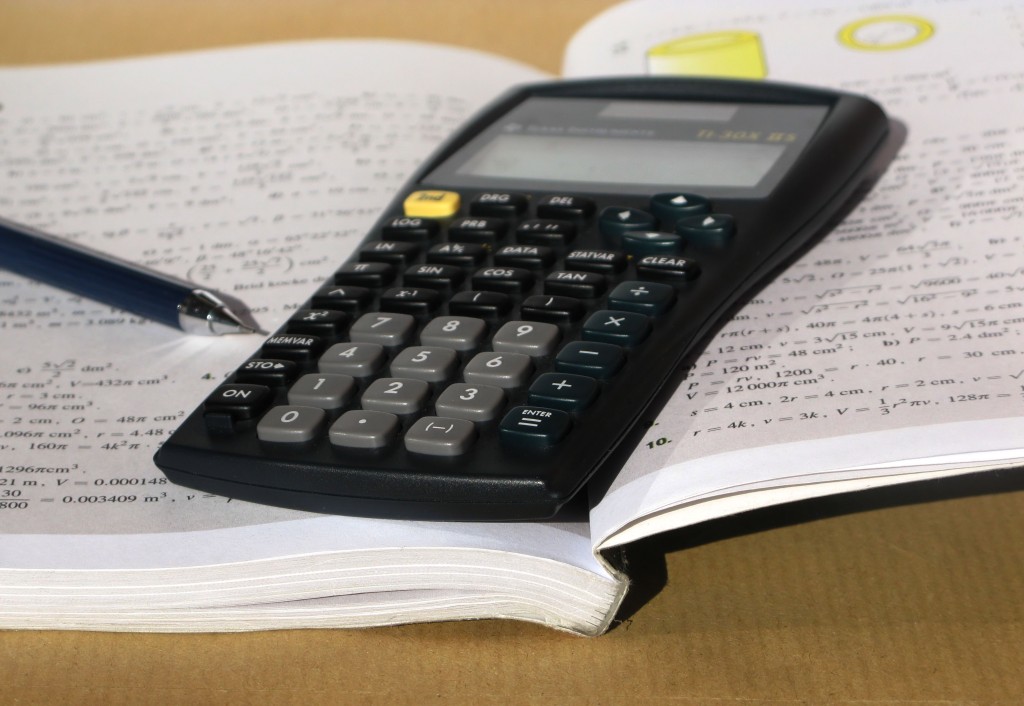

You’ll probably want to pay off other debts earlier, but if your mortgage is your only debt, you may want to throw a chunk of change at that debt. Even though the payoff date may seem years away, you can shave thousands off your interest paid. For example, I used this calculator to see what would happen if I put $3000 down on my mortgage. Just that one payment would save me $6347.58 in interest over the life of the loan. NO investment that you’d make gives you over a 50% return!

Potential savings: $3000 + dollars

9. Pre-fund your Christmas fund

Christmas used to stress me out. No matter how much I tried to save on gifts by shopping smart or making homemade alternatives, I’d always be faced with spending a huge chunk of change at the end of the year. Now I tuck away a bit each month for Christmas. But if your budget is so stretched that it’s hard to save monthly, you can set aside some of your tax return to create a Christmas fund to draw upon in November and December.

The nice thing about having some money set aside for Christmas is that you can use it to buy gifts throughout the year. Believe it or not, but Black Friday is not the best time for bargains. You can pick up presents when you come across them marked down or on sale. Even though it’s April, I already have two gifts for my kid stashed away for December.

Potential savings: $300 + dollars and your sanity (priceless!)

10. Make your house energy smart.

We all know the advantages of an energy smart home. Light bulbs are a good example. For years we have purchased light bulbs and I always looked for those good sales that gave me 4 bulbs for a few bucks. But when you examine it, the purchase of energy-efficient LED light bulbs makes a lot of sense.

The first thing you might want to do is log on the web page of your power company and see if they are running any incentive programs. Ours ran a special where we were able to bring in a 4 pack of bulbs for about $5 as a one time special. LED lights are really dropping in price. A check on Amazon.com confirmed that you can now get them for around $2 a bulb. That’s still far more than I like to pay. But, I ran the numbers and found a different story.

In my neighborhood, a normal 75 watt incandescent light bulb will cost about $32.85 a year assuming a 12 hour lighting day. A comparable LED bulb will cost about $3.94. Factor in the 30,000 hours of expected lifetime for a LED bulb and you’ll end up purchasing 30 more of the incandescent ones. Check out this cool LED bulb saving calculator and run the numbers for the costs for your family. http://www.ledwaves.com/pages/led-calc

You might also consider purchasing some motion sensing light switches. We always followed the kids around the house saying “turn off the lights.” My husband finally gave up yelling at the kids and took a trip to the hardware store and purchased new light switches.

Potential savings: $100-500 dollars

If you spend your tax return in some of the ways that I suggested, you’ll find yourself closer to meeting your financial goals.